2024 Holiday Calendar Philippines Capital Gains Tax – Capital gains tax can be complicated, which is why we put together this guide on capital gains tax rates for 2023 and 2024. Keep in mind there are two different kinds of capital gains tax. . All capital gains, like other profits, are subject to taxes. But there are caveats. For example, if you have a stock with a share price of $100 and it rises to $200 — that is a ‘capital gain’ but not .

2024 Holiday Calendar Philippines Capital Gains Tax

Source : taxfoundation.org

China National Holidays 2024 and Schedule of Adjusted Working Days

Source : www.china-briefing.com

The Capital Law Office Limited | Bangkok

Source : m.facebook.com

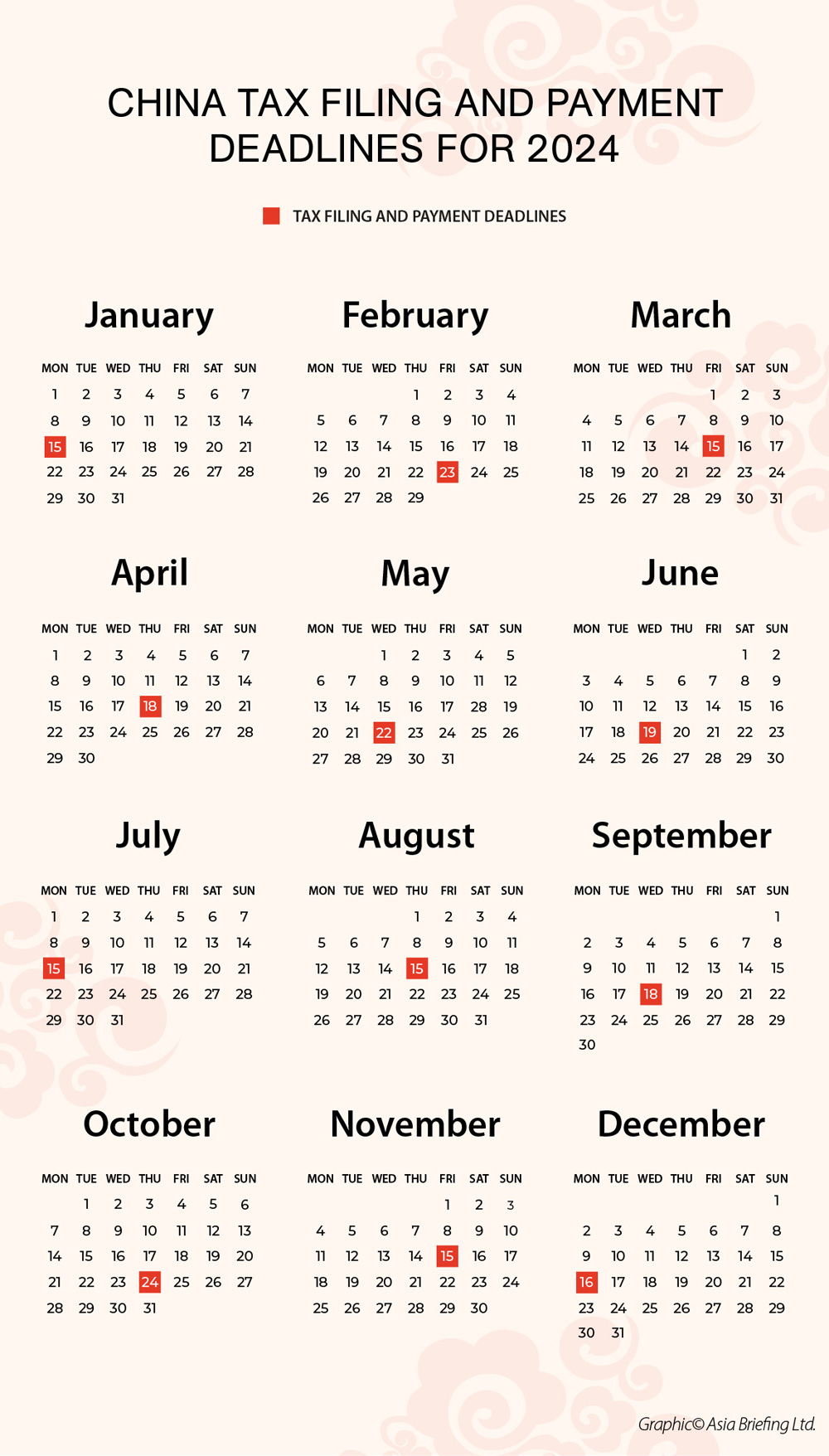

China Tax Filing and Payment Deadlines for 2024

Source : www.china-briefing.com

2024 Capital Gains Tax: Short Term, Long Term Rates & Scope

Source : bnnbreaking.com

China National Holidays 2024 and Schedule of Adjusted Working Days

Source : www.china-briefing.com

2024 Capital Gains Tax: Short Term, Long Term Rates & Scope

Source : bnnbreaking.com

SmartAsset | Nasdaq

Source : www.nasdaq.com

2024 Capital Gains Tax: Short Term, Long Term Rates & Scope

Source : bnnbreaking.com

Year End Tax Planning 2023 2024 | Crowe BGK

Source : www.crowe.com

2024 Holiday Calendar Philippines Capital Gains Tax 2022 State Tax Reform & State Tax Relief | Rebate Checks: Most people won’t owe estate or gift taxes in their lifetimes under current tax laws.) Qualified Dividend and Long-Term Capital Gains Rates: Three rates are still in place for dividends and long . There is a separate set of tax brackets and rates for long-term capital gains and qualified dividends. Investors who have taxable accounts—as opposed to tax-favored retirement accounts such as .